Maximum Ira Contribution 2024 Over 60 Vs. The cap applies to contributions made across all iras you might have. Your roth ira because the account.

If you’re age 50 and older, you. For 2024, if you are married and filing jointly, each spouse can make a maximum roth ira contribution of $7,000 if they have an agi (adjusted gross income) of.

The Contribution Limit For Traditional And Roth Iras Will Increase To $7,000 In 2024.

The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

$23,000 Per Year ($30,500) In 2024 Allow For 401(K) Loans If You Need Money Before Retirement.

Ira contribution limit increased for 2024.

Your Roth Ira Because The Account.

Images References :

Source: elseybmarylou.pages.dev

Source: elseybmarylou.pages.dev

How Much Can You Contribute To A Ira In 2024 Jewel Cornelia, To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 in 2023). The maximum contribution limit for roth and traditional iras for 2024 is:

Source: giselaqermentrude.pages.dev

Source: giselaqermentrude.pages.dev

Sep 2024 Contribution Limit Irs Ceil Meagan, The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, This is an increase from 2023, when the limits were $6,500 and $7,500,. The maximum contribution limit for roth and traditional iras for 2024 is:

Source: rosemariawalida.pages.dev

Source: rosemariawalida.pages.dev

Limit For Roth Ira 2024 Arleen Michelle, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024. To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 in 2023).

Source: alamedawroxy.pages.dev

Source: alamedawroxy.pages.dev

2024 Simple Ira Contribution Limits For Over 50 Beth Marisa, The maximum total annual contribution for all your iras (traditional and roth) combined is: Those numbers increase to $16,000 and $19,500 in 2024.

Source: laureenwreggi.pages.dev

Source: laureenwreggi.pages.dev

New 2024 Ira Contribution Limits Phebe Brittani, Your roth ira because the account. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, The annual contributions limit for traditional iras and roth iras was $7,000 for 2024, rising from $6,500 for 2023. In 2024, employees can contribute $16,000 into their simple ira, which is up from the 2023 simple ira limit of $15,500.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 in 2023). To grow by over 60% over five.

Source: finance.yahoo.com

Source: finance.yahoo.com

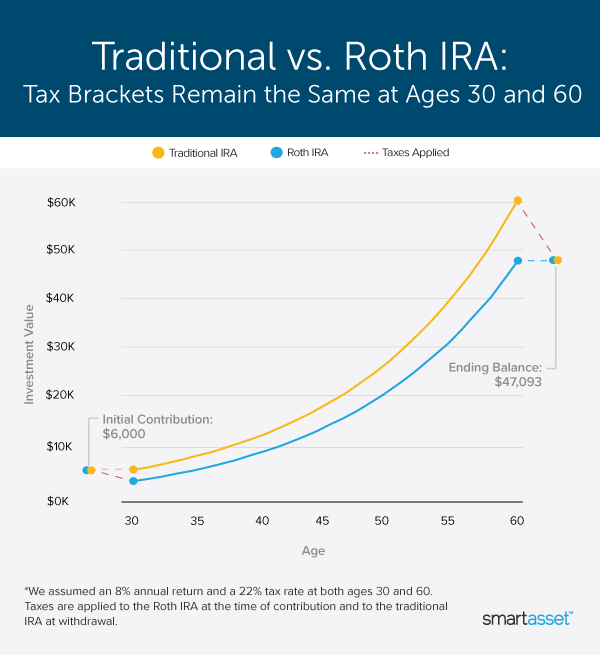

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. Retirement savers age 50 and older can chip in an.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50. Anyone with earned income can contribute to a traditional ira, but your income.

Your Roth Ira Because The Account.

Employees age 50 and older can contribute an extra.

To Grow By Over 60% Over Five.

For both traditional and roth ira s, you can contribute up to $7,000 for 2024, up from $6,500 in 2023.