Max Fica Withholding 2024. For those responsible for employment tax budgets, or just curious. How to calculate fica tax.

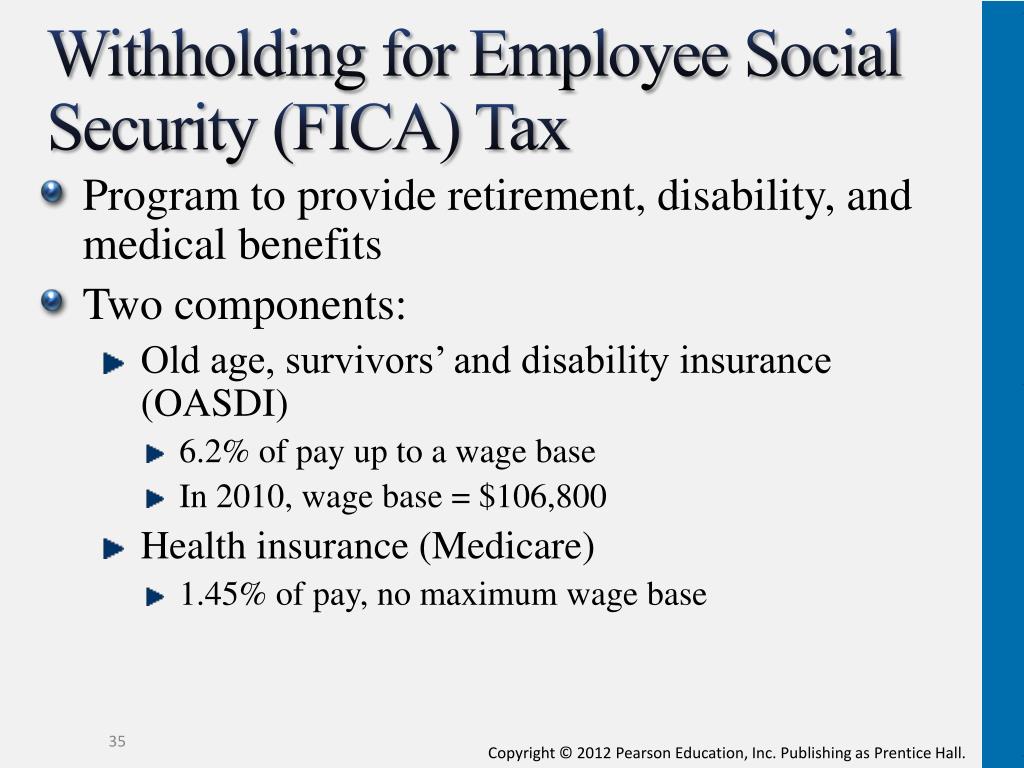

The rate is for both employees and employers, according to the internal revenue code. This amount is also commonly referred to as the taxable maximum.

It Remains The Same As 2023.

However, there is no maximum income limit for the medicare portion of the.

For 2024, An Employer Must Withhold:

The social security tax part is 12.4% and the medicare.

How To Calculate Fica Tax.

Images References :

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, For 2024, an employee will pay: In 2024, the first $168,600 is subject to the.

What is FICA Tax? The TurboTax Blog, So, you’re looking at a potential $7,500 increase in the taxable wage base from this year to next. In 2024, the social security wage base limit rises to $168,600.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Pay Medicare Withholding Fica Withholding, The social security wage base has increased from $160,200 to $168,600 for 2024, which increases. That’s up from the current number of $160,200.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Calculate Fica And Medicare Tax Withholding, To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and medicare. In 2024, the social security wage base limit rises to $168,600.

Source: ianannaleigh.blogspot.com

Source: ianannaleigh.blogspot.com

Calculate fica and medicare withholding IanAnnaleigh, The social security wage cap will be increased from the 2023 limit of $160,200 to the. For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), So, you’re looking at a potential $7,500 increase in the taxable wage base from this year to next. To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and medicare.

Here are the federal tax brackets for 2023 vs. 2022, It remains the same as 2023. Every payday, a portion of your check is withheld by your employer.

Source: ianannaleigh.blogspot.com

Source: ianannaleigh.blogspot.com

Calculate fica and medicare withholding IanAnnaleigh, For 2024, an employer must withhold: This amount increases to $168,600 for 2024.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, For 2024, the total amount of fica tax withheld totals 15.3%, again with most employees paying half, splitting the amount with their employer (unless you have. To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and medicare.

Source: medicare-faqs.com

Source: medicare-faqs.com

When Is Medicare Disability Taxable, In 2023, only the first $160,200 of your earnings are subject to the social security tax. For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

For Those Responsible For Employment Tax Budgets, Or Just Curious.

The social security tax part is 12.4% and the medicare.

The Maximum Amount Of Social Security Tax An Employee Will Have Withheld From Their Paycheck In 2024 Will Be $10,453.20 ($168,600 X 6.2%).

In 2023, only the first $160,200 of your earnings are subject to the social security tax.