Georgetown County Delinquent Tax Sale 2025. Bidders must register in advance with the georgetown county delinquent tax department. To encourage voluntary compliance with the tax laws of the state of south carolina and the tax ordinances of georgetown county.

If judgment is entered, a lien on. To encourage voluntary compliance with the tax laws of the state of south carolina and the tax ordinances of georgetown county.

For Tax Sale Property Listings Please Click Here.

Next, generally in october, the county collector applies to the circuit court for judgment and order of sale for the taxes on the delinquent properties.

The Registration Period Will Begin On Thursday, October 24, 2022 And Will Close Promptly At Noon On Thursday, November 10, 2022.

Constables > constable precinct 3 > delinquent tax sales.

Georgetown County Delinquent Tax Sale 2025 Images References :

County Delinquent Tax Sale 2025 Berte Melonie, Properties on the tax sale list can be viewed below, downloaded and/or printed here, or viewed on this gis map. This page provides direct links to essential resources for tax assessments, document retrieval, information search, payment records, and lien records.

Source: retipster.com

Source: retipster.com

Everything You Need To Know About Getting Your County's "Delinquent Tax, Georgetown county voters could be asked to approve two penny sales tax increases in 2025. Georgetown county's annual tax sale is just weeks away, and registration for the event officially opened on thursday!

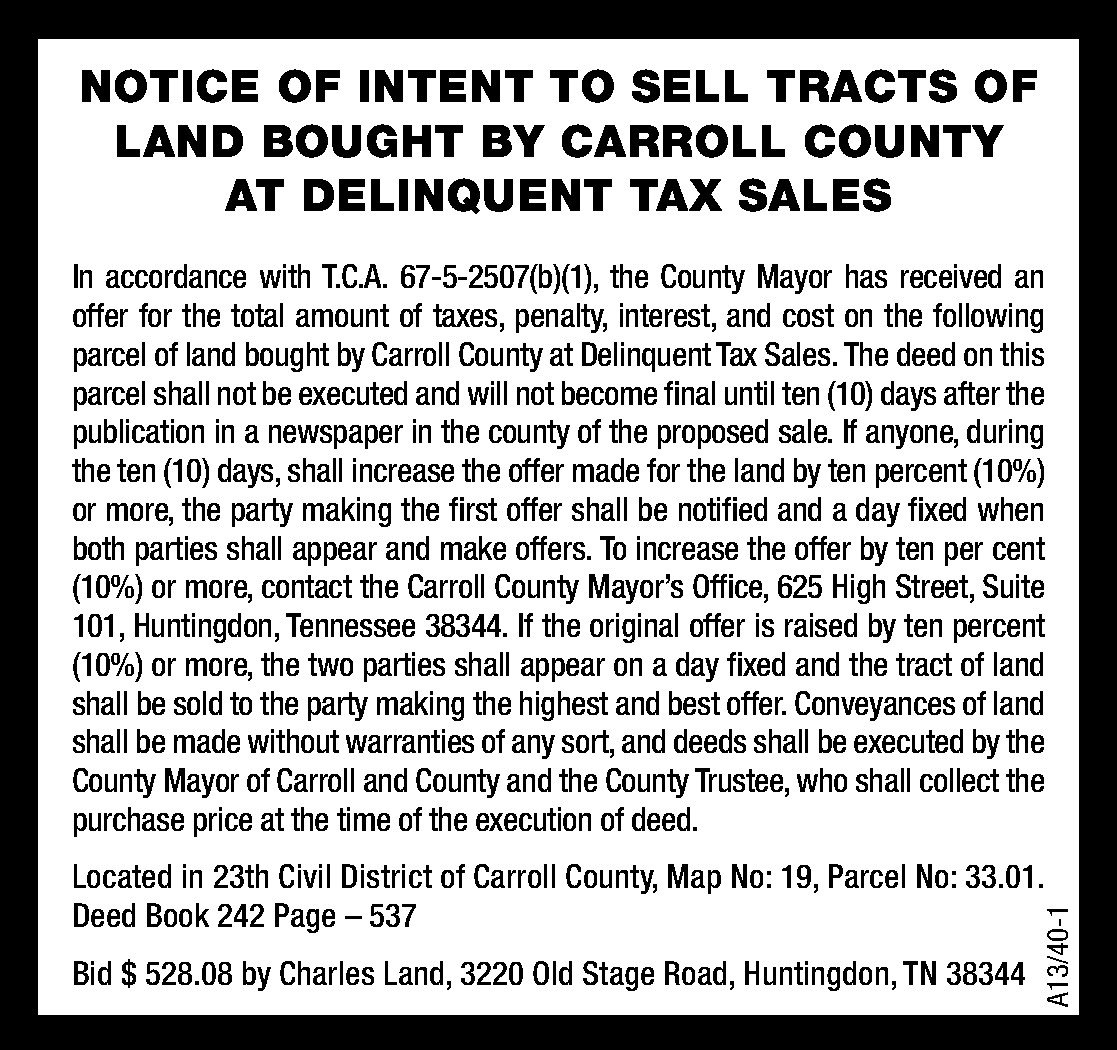

Source: www.mckenziebanner.com

Source: www.mckenziebanner.com

Notice of Intent to Sell CC Delinquent Taxes The Mckenzie Banner, To encourage voluntary compliance with the tax laws of the state of south carolina and the tax ordinances of georgetown county. Georgetown county, sc, currently has 244 tax liens available as of july 16.

Source: salinapost.com

Source: salinapost.com

Dickinson County delinquent tax sale attracts large crowd, Properties on the tax sale list can be viewed below, downloaded and/or printed here, or viewed on this gis map. Whenever the tax commissioner's office has a tax sale scheduled, the date, time and location of the sale can be found here, in addition to the legal advertisement.

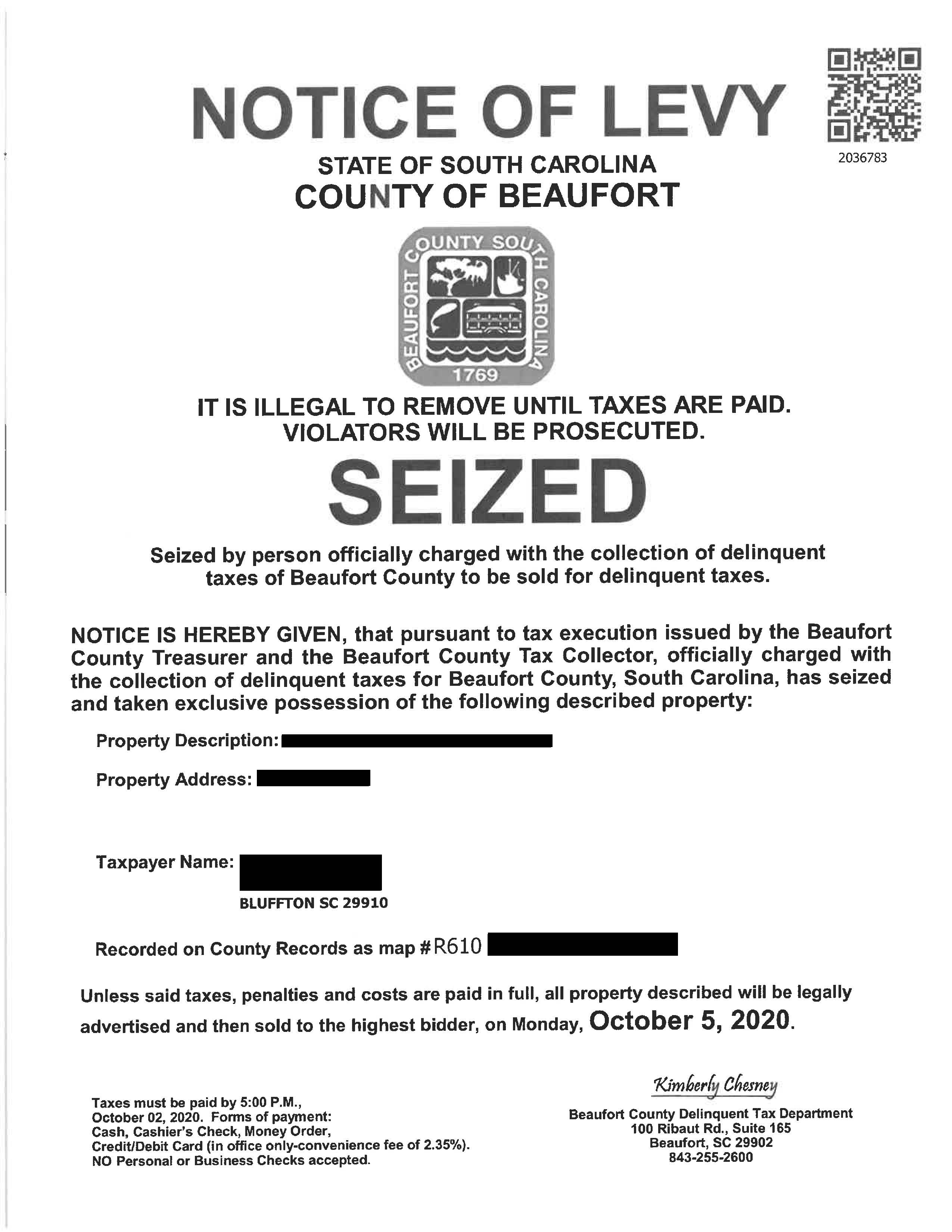

Source: treasurerhelp.zendesk.com

Source: treasurerhelp.zendesk.com

How am I notified that my property may be auctioned at the delinquent, You may call the delinquent tax department at georgetown county and make arrangements to pay the delinquent taxes online. A local option sales tax (lost) and a capital.

Source: www.youtube.com

Source: www.youtube.com

Wholesaling Tax Delinquent Properties Here's How to Find Your Local, This page provides direct links to essential resources for tax assessments, document retrieval, information search, payment records, and lien records. A local option sales tax could lower local property tax bills in the future.

Source: www.youtube.com

Source: www.youtube.com

Delinquent Taxes and Tax Certificate Sale YouTube, A local option sales tax could lower local property tax bills in the future. Properties on the tax sale list can be viewed below, downloaded and/or printed here, or viewed on this gis map.

Source: insert-laughthers.blogspot.com

Source: insert-laughthers.blogspot.com

cook county delinquent tax sale list Milly Ivy, Georgetown county, sc, currently has 244 tax liens available as of july 16. The amount advertised includes the unpaid.

Source: christophergiuffrebooks.com

Source: christophergiuffrebooks.com

Complete Guide To Delinquent Property Taxes Christopher L. Giuffre Books, Starting on monday, september 9, 2025, a listing of properties will be available on the charleston county website and in the delinquent. Constables > constable precinct 3 > delinquent tax sales.

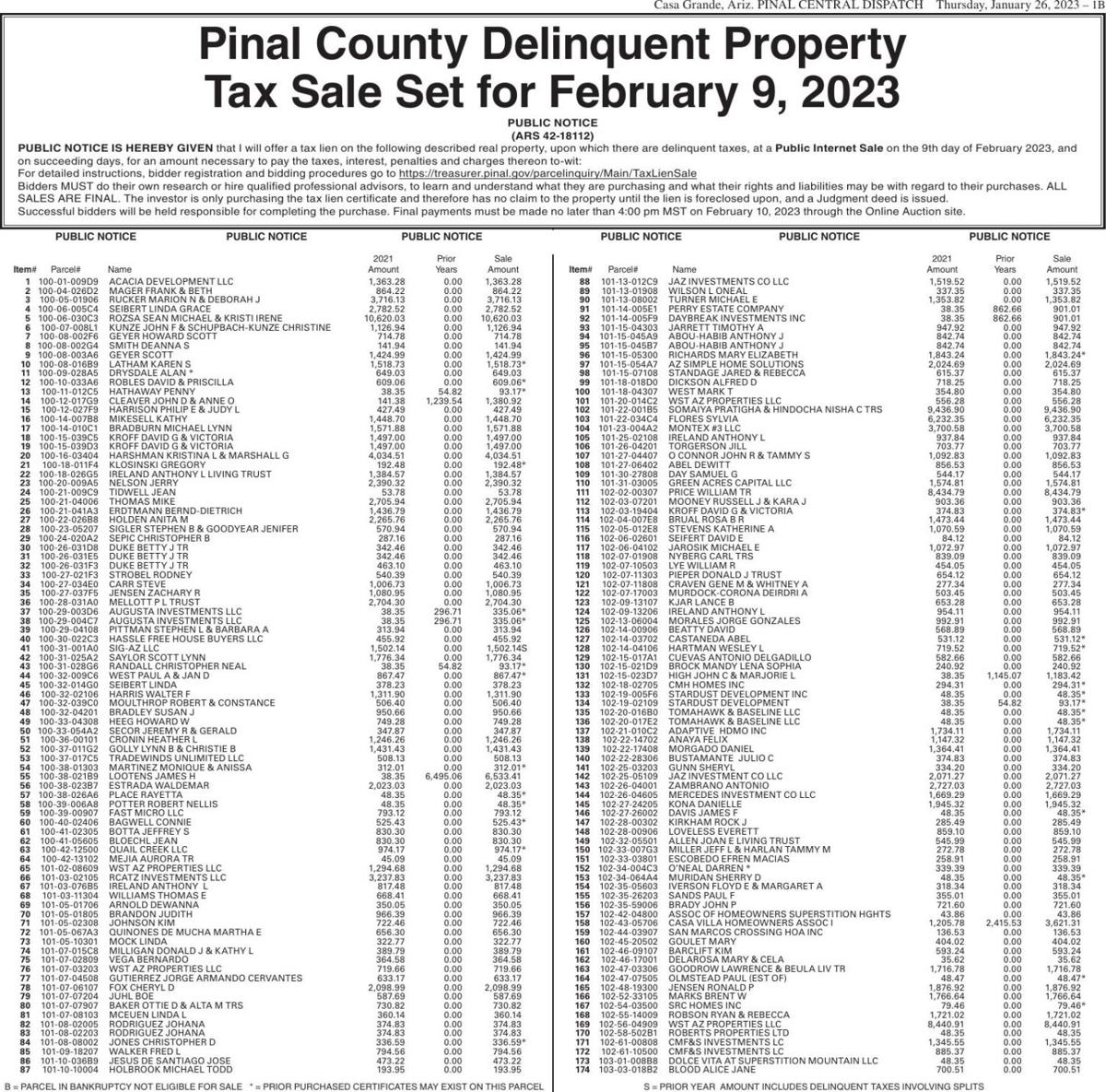

Source: www.pinalcentral.com

Source: www.pinalcentral.com

Pinal County Delinquent Tax Sale 2023, Georgetown county tax collector’s office is preparing for the. Next, generally in october, the county collector applies to the circuit court for judgment and order of sale for the taxes on the delinquent properties.

This Office Does Not Process Any Type Of Bank Foreclosure Sales.

The georgetown county treasurer’s office will begin using a third party collections agency, american financial credit services (afcs), to assist in the.

Prior To The Tax Certificate Sale, The Tax Collector Advertises The Delinquent Taxes For Three Consecutive Weeks In A Local Newspaper.

The delinquent tax sale is monday, october 28, 2025, at the lovely hill convention center located at 5905 w jim bilton blvd., st.

Category: 2025